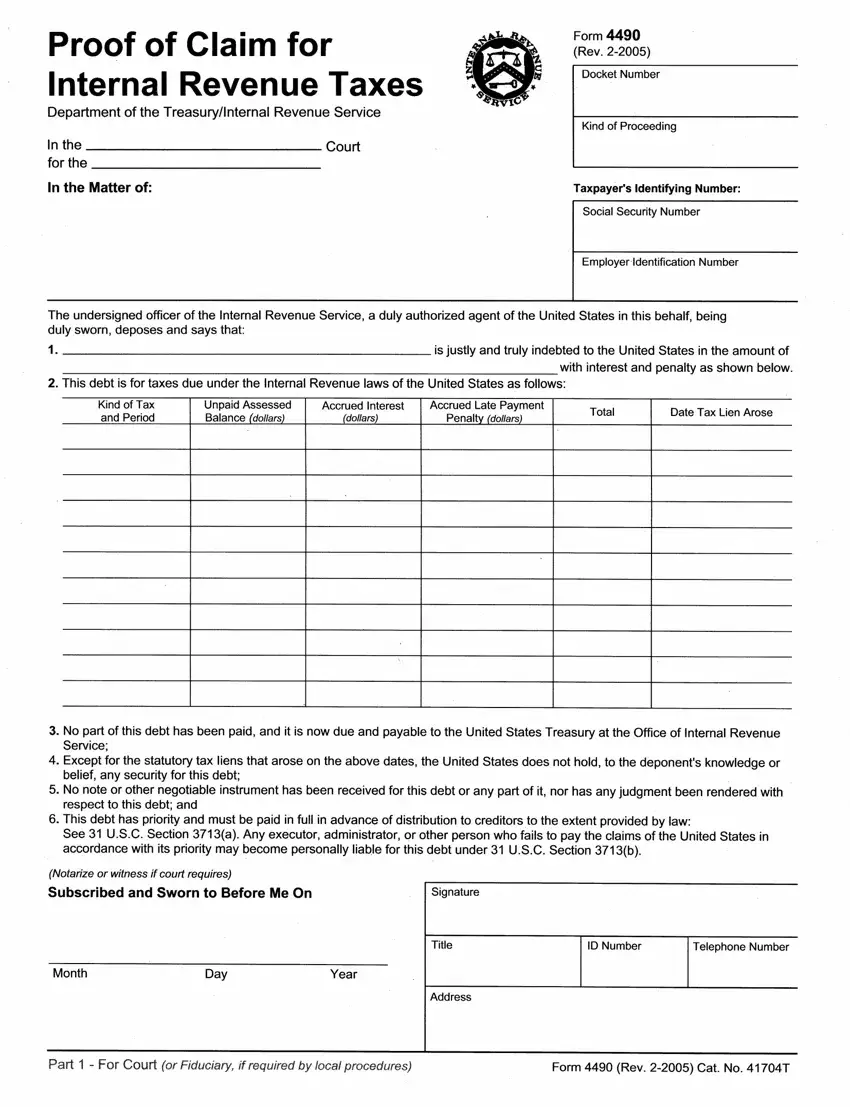

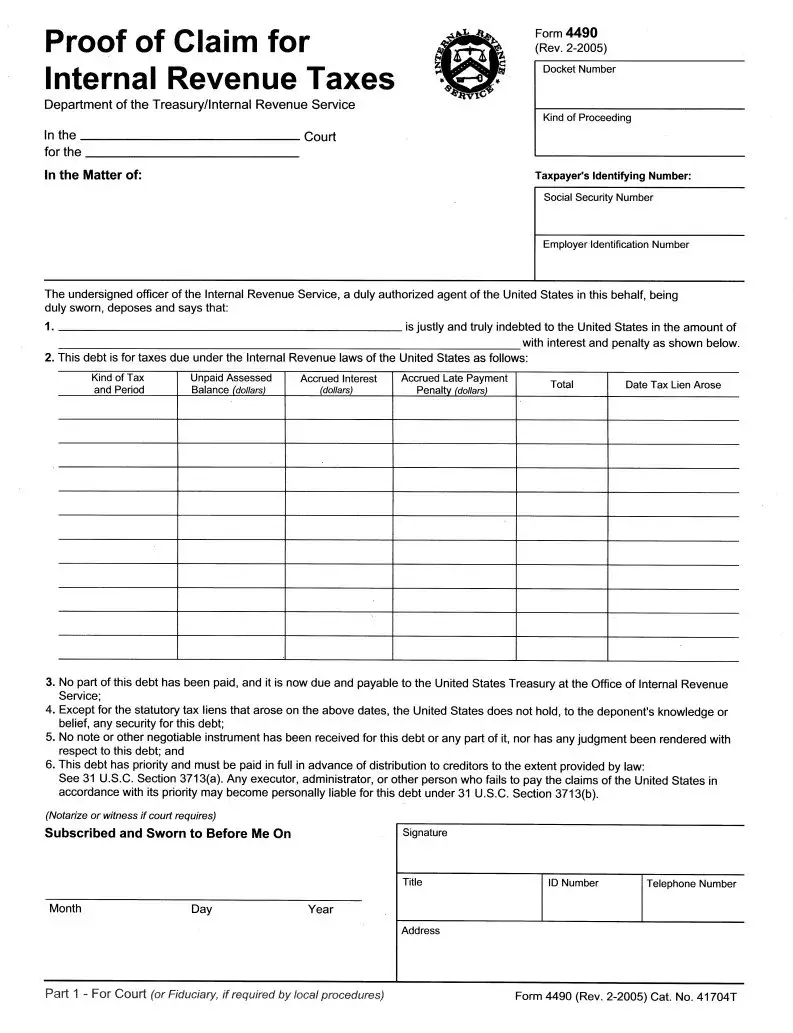

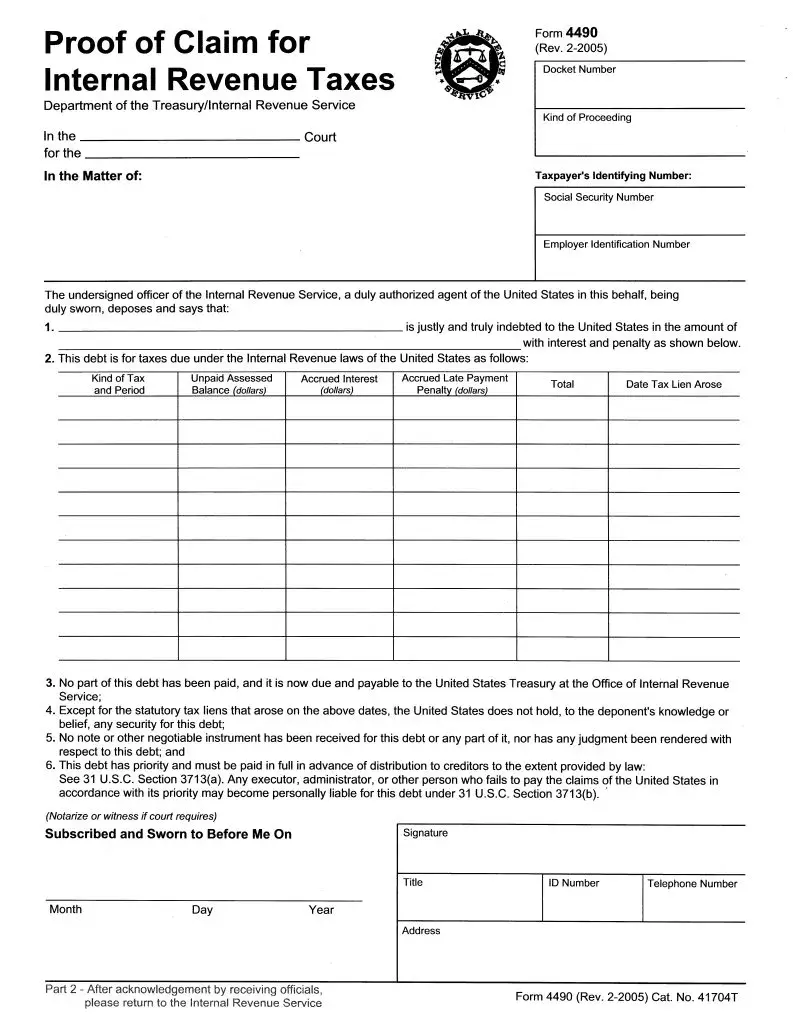

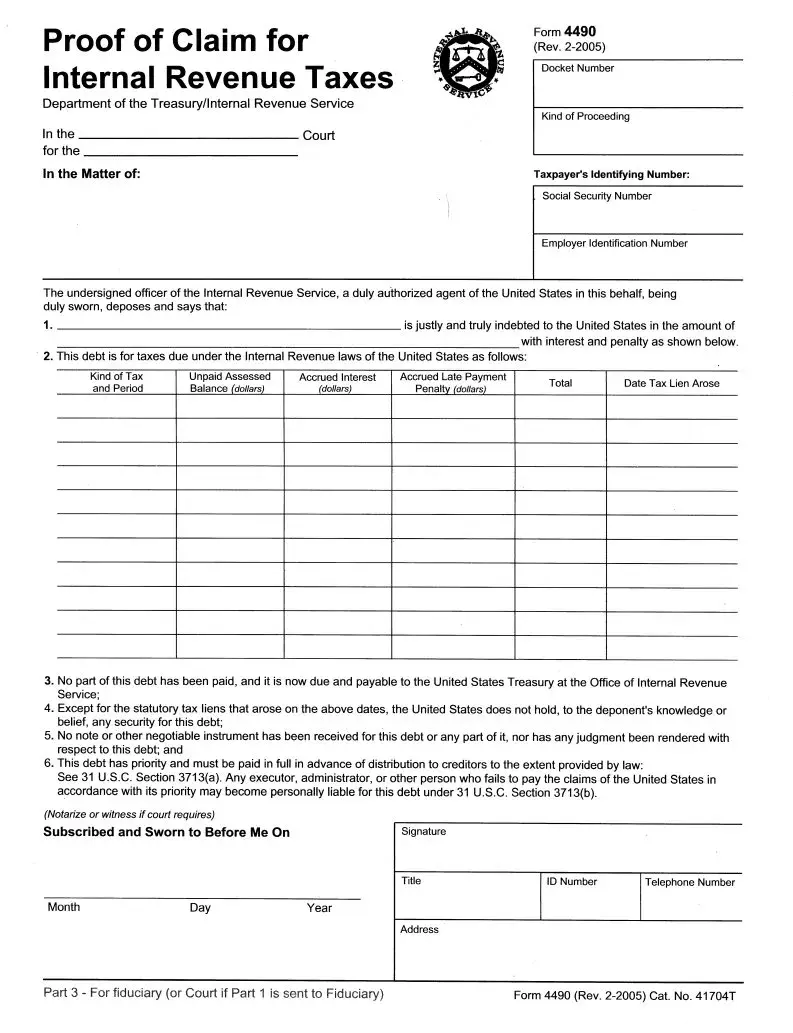

Our PDF editor can make writing files convenient. It is extremely convenient to update the [FORMNAME] document. Keep up with these particular actions if you want to do it:

Step 1: Click the "Get Form Here" button.

Step 2: So, you are able to update the irs 4490. Our multifunctional toolbar allows you to insert, get rid of, adapt, highlight, as well as carry out similar commands to the words and phrases and areas inside the document.

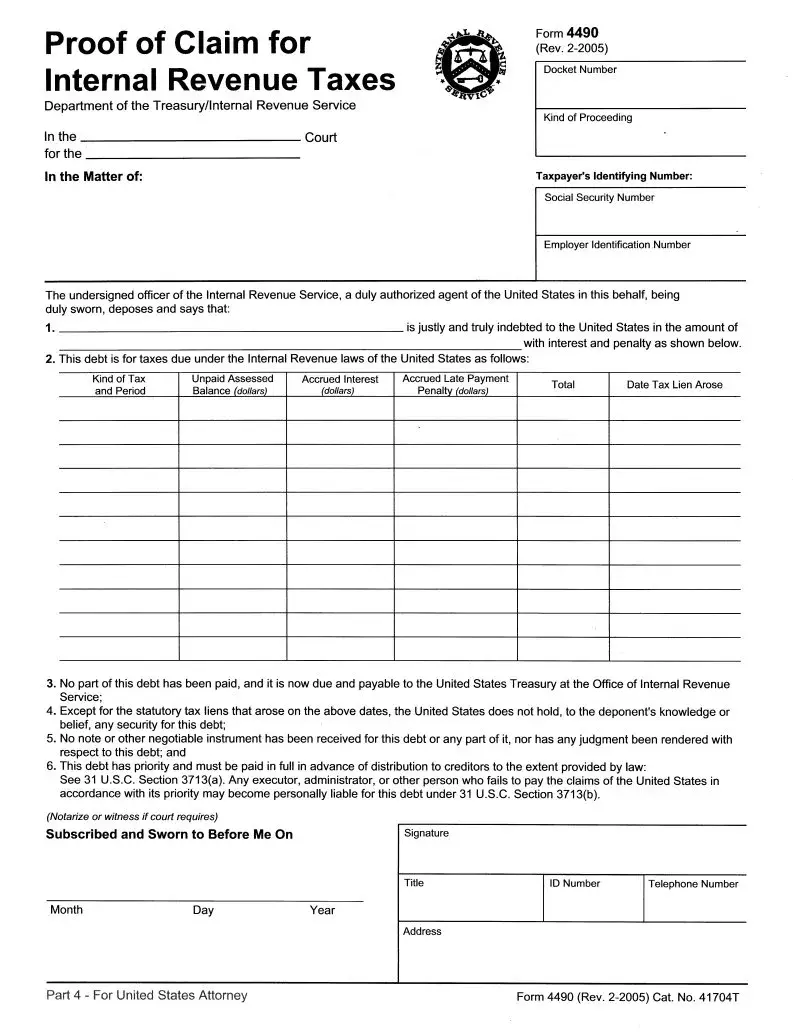

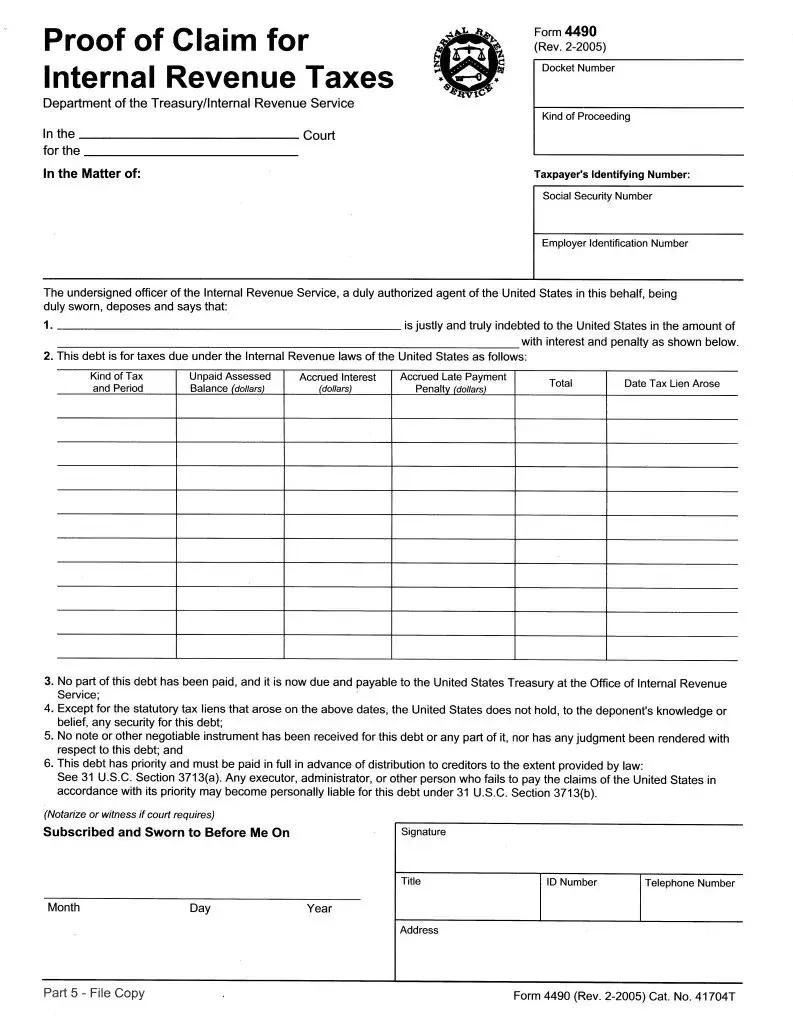

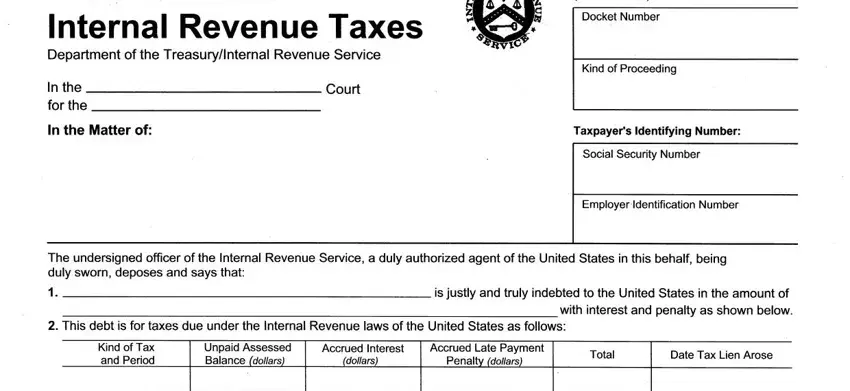

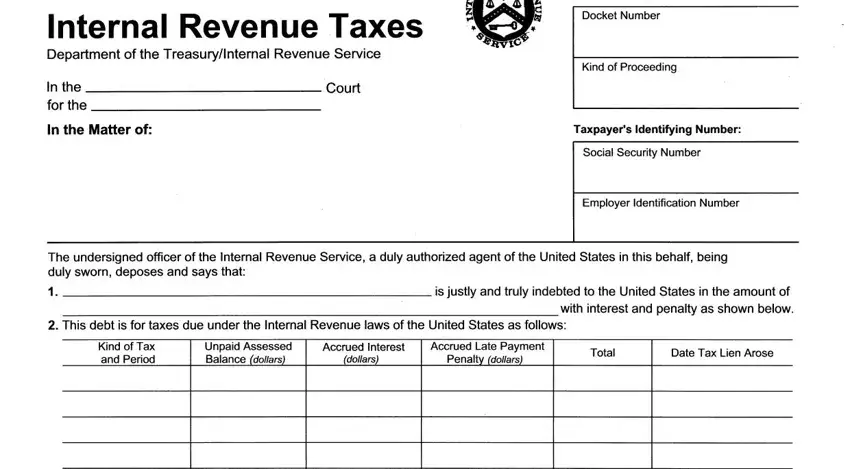

You should provide the following details to fill out the irs 4490 PDF:

Write down the demanded data in the field .

You should include some data inside the section .

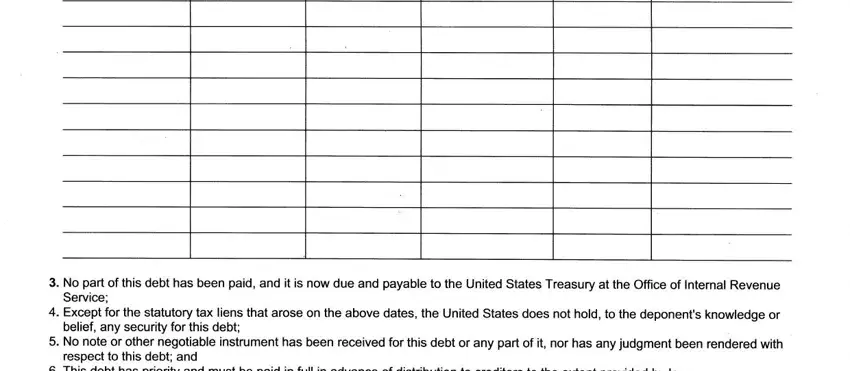

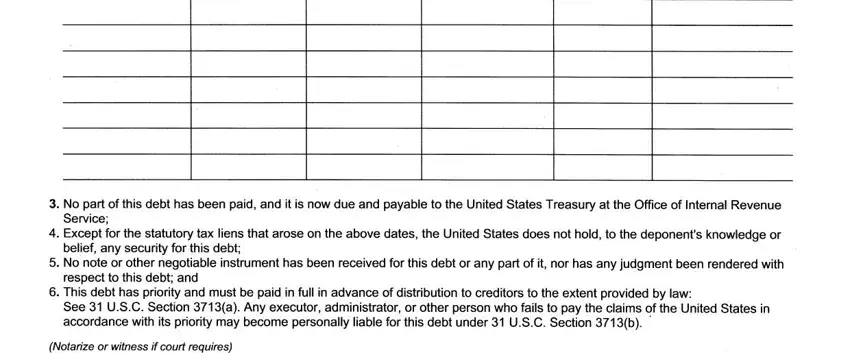

The space is going to be where you can include both parties' rights and responsibilities.

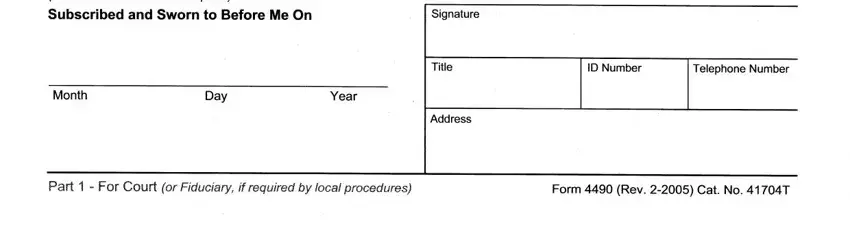

End by looking at the following areas and submitting the relevant data: .

Step 3: When you are done, click the "Done" button to transfer the PDF form.

Step 4: Be sure to stay clear of possible future misunderstandings by getting a minimum of 2 copies of your form.